NXP Semiconductors has added to the falling results in the wider semiconductor business with full year results down 5% to $12.61bn.

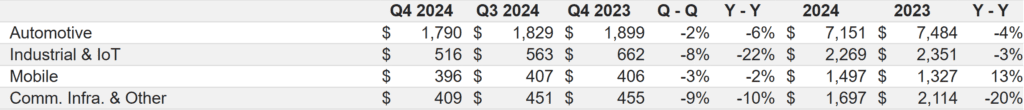

The fall reflects the weakness in the global automotive market, and particularly in Europe. Automotive is the largest segment for the company at $7.15bn, down 4% on the year from $7.48bn. This comes after the planned acquisition of European software leader TTTech Auto for $625m and SerDes developer Aviva Links for $242m. The company raised €1bn in a loan form the European Investment Bank to fund projects through this year and 2026.

- Future Horizons lifts 2025 forecast in fragile market

- NXP sees weak start to 2024

“In the fourth quarter, revenue was $3.11 billion, a decrease of 9 percent year-on-year, modestly above the mid-point of our guidance range. In review, NXP delivered resilient results throughout 2024, reflecting solid execution, consistent gross margin, and healthy free cash flow generation despite a challenging market environment. We rigorously focus on managing what is in our control, to navigate a soft landing while executing our growth strategy,” said Kurt Sievers, NXP President and CEO.

Other segments were down, with industrial and IoT down 3% from 2.27bn from $2.35bn. The company saw the launch of the i.MX 94 family for industrial control, telematics, gateways, and building and energy control. This includes Ethernet Time Sensitive Networking (TSN) switching capabilities

The communications infrastructure business continued to fall, down 20% at $1.67bn.

Breakdown of NXP Semiconductor business in 2024

However, NXP saw its mobile business pick up, growing 13% to $1.5bn on the back of smart home security and ultrawideband wireless technology for applications such as smart locks. It has been expanding that UWB technology into the industry’s first wireless battery management system (BMS) based on the technology in its FlexCom family of wired and wireless BMS.

Leave a comment